A new business structure for scaling enterprise growth: Growth Process Outsourcing

Growth process outsourcing is BPO for complex sales and marketing processes. Business process outsourcing (BPO) is a familiar term for most in the...

12 min read

Admin : Feb 28, 2023 5:52:02 AM

Helping your future customers advance from RPA initiative to great ROI

By Kyle Hansen & Yuriy Koshulap

This industry-specific report is intended for sales & marketing leaders who have a responsibility for both demand generation as well as progressing identified RPA business opportunities into successful projects. The purpose is to analyze current market developments and advise based on these observations.

The main challenge for RPA vendors is in navigating a rapidly shifting enterprise market to solidify their positions as leaders. Vendors must act now to grow their businesses and take advantage of the well-publicized excitement about the technology’s automation capabilities whilst managing expectations regarding delivery. To accomplish this, RPA vendors should focus on targeted account-based sales & marketing efforts for prospects where there will be definite ROI after implementing RPA solutions.

The main topics discussed include:

Looking towards the RPA market’s future

In recent years, businesses have begun to strategically assess how they work, what gets done, by who, and where automation can add value to their organizations. Business users exhibit great excitement over Robotic Process Automation solutions that can help them achieve significant cost savings and streamline processes, without the long-term hassles that come along with implementing big technology projects. Considering the current environment where meeting face-to-face has been compromised, virtual outreach has become more and more important.

RPA has been hailed as the fastest growing market in enterprise software. Gartner reported 63% growth in 2018, which was fueled by this excitement. The benefits of this technology have been highly-touted as indispensable in today’s digital process automation landscape. Alternatively, it has also been disparaged by IT professionals as a mere re-packaging of older technology and an over-hyped solve-all for general inefficiencies.

The truth lies somewhere in the middle.

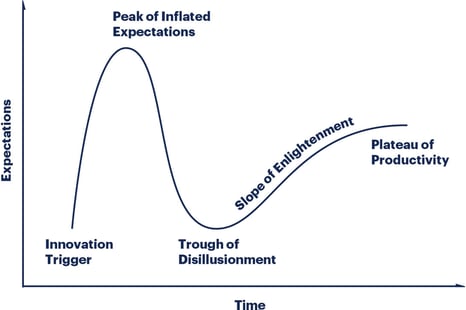

In either case, there is still currently a great demand for tools that can live up to RPA’s lofty promises to drive efficiency, reduce human error and empower knowledge workers to focus on critical tasks. As Eric Johnson, CEO of Nintex notes, the hype surrounding RPA has started to be replaced by understanding the realities of what can be achieved by utilizing these solutions. In Johnson’s estimation, we are seeing RPA reach a key point of market inflection.

The value proposition for RPA is clear. Enterprises currently crave solutions that will allow them to cut out repetitive tasks from their general workflow and allow their employees to focus on doing work that requires high levels of judgement, creativity and critical thinking. Furthermore, many have proposed the idea that RPA is a “gateway” technology for enterprises to become more comfortable adopting full-scale AI & Machine Learning solutions. The idea being organizations do a “light” implementation of RPA to prepare their 1000+ employees to fundamentally change their operations with “heavier” implementations of AI or Machine Learning solutions. All in all, RPA is increasingly being viewed as a necessary addition for enterprises completing their digital transformations.

With the market for RPA solutions maturing quickly, vendors must act quickly to take advantage of this unique timing and cement their positions as leaders.

One of the main challenges to focus on is helping customers successfully implement RPA solutions, taking them from the interest in automation to deploying a system that yields their desired results. This will require a significant investment in proactive sales strategies and effective marketing decisions. Vendors must work intimately with their future customers to understand the exact path they want to take. All of which must be strengthened by success stories to be competitive with the numerous other vendors. In terms of market position, extending your presence beyond America and Europe, where these solutions are currently most likely to be adopted.

Additionally, the dynamics of the marketplace are changing. Legacy players like Microsoft and SAP are expanding their product offerings to include RPA, current leaders like UIPath, Automation Anywhere & Blue Prism are shoring up their gaps in their technology portfolio via acquisition and the less-established players are competing to put themselves at the head of the pack.

As 2018’s rapid market growth shows, enterprises have become very comfortable with the idea of utilizing RPA solutions to achieve their goals of automating repetitive, prone-to-human-error, or compliance-vulnerable tasks. However, by 2020, there’s been enough over-selling of the hype for these same enterprises to have grown wary of smokescreen promises. Therefore, what RPA vendors should focus on is developing productive long-term relationships and establishing credibility in terms of customer success. For sales & marketing leaders, this process starts at the initial outreach stage. Bad-fit leads must be filtered out at the very beginning and enterprise prospects must be qualified to enter the pipeline on the basis of a proveable ROI in the future. Furthermore, more sales resources must be dedicated to the planning & negotiation stage, where both RPA vendors and clients collaborate on charting & navigating a path towards successful deployment. If this doesn’t happen, and the motivation to implement your RPA solution is justified solely by the enthusiasm over new technology or FOMO, there will be long-term consequences.

Who is buying RPA? Why?

Forrester Research initially predicted 1 billion USD growth for 2019. By the end of the year, they conceded that they had underestimated the market’s appetite for RPA solutions. A common consensus heralds RPA as a key technology to help enterprises further their digital transformation journeys. The market’s extreme growth is primarily being driven by investment. Unicorns like UIPath have attracted billions of dollars from VC’s who are eager to take advantage of the growing comfort level with emerging technologies.

The maturation of the market has also turned the heads of legacy players. Both Microsoft and SAP have recently thrown their hats into the ring and expanded their product offerings to include RPA solutions. The impact after these powerful brands enter the marketplace cannot be accurately measured at this time but should not be underestimated nonetheless, particularly by vendors who do not occupy the vaunted top-3 name-brand space. For sales & marketing leaders within current RPA vendors, the timeline to act now is strict in order to capture enterprise business before the heavyweight brands enter the market space and before the top 3 leaders consolidate their grip at the forefront.

In terms of who your reps should be pursuing, as a former RPA salesperson notes, an enterprise CIO is not the ideal buyer persona. The CFO or CPO are the ones who stand to benefit the most from RPA and the most likely to champion implementation within their organizations. In fact, if the CFO or CPO are engaging with your salespeople, this likely indicates a failure from their CIO’s side to meet expectations. After all, one of the key components of RPA’s value proposition, is allowing non-technical business users to add a technology layer to their organizations to improve processes.

In this regard, CIO & CTO’s are likely to be obstacles, as they understand very clearly how intensive it can be to introduce an additional technology layer. This disconnect within the C-suite of prospective enterprises is one of the main drivers of the RPA debate, which we will discuss in the next section.

The RPA Debate

While there is universal consensus that the RPA market will continue to be a hot topic amongst the enterprise C-suite, there is a very fierce debate regarding full-scale deployment of the technology. While ease of implementation is one of the main talking points, recent case studies of project failures have been a cause for concern. For enterprise prospects who are eager to adopt such solutions, this debate will be at the forefront of their decision-making process. In 2020 and beyond, their main concern will be navigating the technological hype and ensuring that, if they choose to champion RPA solutions within their organizations, they can prove the added value.

By this point, there’s enough evidence to show both the added value as well as examples where the technology failed to meet expectations. From multiple reputable sources, many have denounced RPA vendors as overselling their technology and promising smoke and mirrors. Surveys conducted by Deloitte and Ernst & Young show that around half of RPA implementations fail to meet expectations in terms of cost and delivery. Meanwhile, investors are still pouring funding into RPA companies, with the expectation that the market will only continue to grow.

Francis Carden, who serves as VP of Digital Automation and Robotics at Pegasystems, writes, “There isn't a day goes by, when I don't hear from a multitude of senior executives who are perplexed as to why they are the "only ones" that can't seem to scale. Some are on their 3rd or even 4th RPA vendor or consulting firm yet still, chasing the dream - and they remain stumped!”

Carden, who founded RPA vendor Opensoft, which Pegasystems acquired in 2016, is referring to the actual effectiveness of RPA solutions within the enterprise market versus the expectations. After all, automating attended or unattended bots to handle tasks formerly done by humans will depend on the people who build them. There must be a clear vision established before full scale deployment to prevent failure.

Eric Johnson, CEO of Nintex, says that more and more enterprises are exiting the hype stage and getting more realistic about what they can utilize RPA to achieve, claiming, “Pureplay RPA vendors are overselling their solutions and not speaking the truth about the reality of what an RPA bot can do. Rolling out and maintaining an army of bots is a formidable challenge, and too often, the industry doesn't acknowledge the realities of this challenge.”

Johnson, whose company recently purchased RPA vendor Enablesoft, echoes Carden’s commentary on the disconnect between expectation and feasibility. Likewise, Phil Fersht of HFS Research, a company which focuses entirely on understanding developments within the field of process automation and was commissioned by RPA powerhouse Blue Prism to introduce their RPA offering in 2012, states “In our recent survey of 590 G2000 leaders, only 13% of RPA adopters are currently scaled up and industrialized . . . RPA provides a terrific band-aid to fix current solutions; it helps to extend the life of legacy. But does not provide long-term answers.”

Meanwhile, investors are still pouring funding into RPA companies, with the expectation that the market will only continue to grow. Firms are flocking towards the major companies with established presences as well as seeking out smaller, niche players to gamble on. Established players are expanding their product lines or partnering up with powerhouses in other industries to extend their reach, with Forrester predicting that globally the RPA market will grow to $7.2 billion by 2025, at expected rate of 32.6% CAGR.

Customer demands are increasingly becoming more complex as well, as expectations are changing in the wake of new developments. What is driving this disconnect between investor excitement, clear customer demand and apprehension? Furthermore, what does this mean for sales & marketing?

First off, sales cycles will lengthen as the C-suite balances excitement over the technology with a more realistic understanding of what they can achieve with RPA. For salespeople and marketers, this means they must dive into their future customers priorities and deeply understand what they’re trying to achieve. Failure to do this will result in, perhaps a short-term success in terms of RPA adoption, but long-term detriment if the buying organization cannot match the results with their desired expectation. In a marketplace where vendors are in constant competition and demand is high, a track record of proven success is crucial.

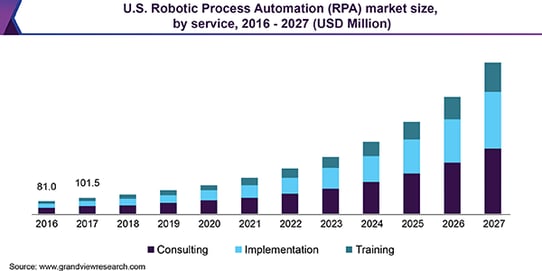

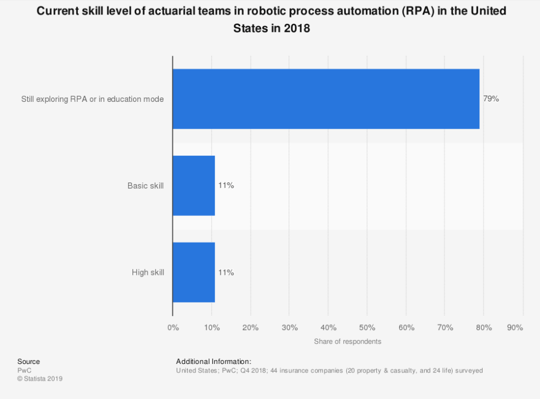

An example of the challenges that RPA vendors face is that many prospects are still at the stage where they’re interested in RPA and are trying to educate themselves. Without clear guidance in this regard, many implementations are bound to either fail or exceed deadlines within their organizations. Many organizations do not have specialized teams that can help with adding this additional technology layer. As you can see:

Sales cycles will likely become longer, due to the fact that business users will be more careful and involve more stakeholders in the decision-making process as they familiarize themselves with the logistics.

While the enthusiasm around RPA’s technological promise will likely continue for the next few sales cycles, the primary challenge for RPA vendors is in proving credibility that they can add tangible value to the organizations they serve and--crucially--in managing the expectations regarding the technology’s capabilities. This is a time and labor intensive task for sales & marketing leaders.

Carden, Johnson & Fersht all advise that enterprises who seek to adopt these solutions turn a clear eye to the fact that RPA is still an emerging technology, and to focus on making sure all the ducks are lined up during the implementation phase and proper expectation-setting in terms of what can realistically be achieved during the initial outreach. RPA Vendors and the clients they help must collaborate from the earliest stage of engagement to arrive at success. So what are prospects concerned with now?

For enterprise prospects in 2020 and beyond, buyers are concerned with interpreting technological hype.

The main challenge to focus on is not in creating awareness for the technology; that's already been accomplished. Rather, the goal should be differentiating your vendor’s offering and educating prospects on how you can help them achieve specific goals. Not every business stands to benefit from RPA’s technological promise, though many business leaders are excited by what’s being offered. Therefore, RPA vendors and prospects must work together closely to ensure positive outcomes.

Market Dynamics & Growth Predictions

Forrester Research expects to see growth for the RPA market to reach nearly 3 billion USD in 2021. Adding AI capabilities to RPA’s scope, to include automating tasks beyond the rote and repetitive is one major reason as to why excitement and spending are due to increase. As noted by experts, customer demands will become increasingly more complex and specific as the overall excitement reaches more people. This will happen as business & IT leaders gain a better understanding of how they can utilize attended and unattended robots to save their organizations money and make them more efficient.

Currently, the top-five RPA vendors:

. . . dominate 47% of the market.

VC’s are still pouring funding into both the leaders and the fledgling upstarts of the RPA world. At the head of the pack -- UIPath, Blue Prism, Automation Anywhere -- are using the recent injection of funding to shore up their technological weaknesses and expand their geographic presence. Within a very recent timespan:

Blue Prism acquired Thoughtonomy, folding the company into an independently-operated business unit and relaunching it as Blue Prism Cloud.

UIPathbought both Stepshot and Process Gold

Automation Anywhere “acqui-hired” Cathyos Labs as well as purchasing Klevops

Other companies have also been buying up RPA vendors, in the hopes of securing a stronghold within this burgeoning space. The aforementioned Nintex bought EnableSoft, the maker of Foxtrot RPA, to expand their product offering to meet customer demand. This month, publications announced Microsoft’s formal debut into the RPA space, and they bring a vast ecosystem of partners and strong resources into the marketplace. Powerhouse tech company SAP also acquired Contextor to add RPA functionalities with their existing products. While this move isn’t without criticism, that powerful legacy companies are due to enter this space (while current leaders are not as steady as they seemed just last year), signals that the marketplace will change extensively. Vendors should prepare for this eventuality.

Meanwhile, expert consultancies are expecting business interest in this space to only increase. The benefits and value proposition continues to turn heads within the C-suite. In its 2019 survey with 270 decision makers from operations groups, shared services, finance, and other lines of business from France, Germany, the UK, and the US, Forrester finds that:

Business users believe that automation offers tangible business benefits and hope to empower their employees to focus on higher-value tasks and improve employee engagement.

According to their research, more engagement from their employees correlates with growth. A 5% improvement in employee engagement leads to a 3% increase in revenue.

While the technology is not perfect yet, enterprise prospects understand that it’s a force to be reckoned with. Each job will be affected in some way, whether these jobs are cannibalized, new ones are created while others transform.

Sales & Marketing leaders must take action now

It’s key that RPA vendors act quickly to solidify their standing within the field, establish long-term relationships with customers and help these clients navigate through the “trough of disillusionment” into the “plateau of productivity”. The entrance of legacy players like Microsoft and SAP will surely upset the balance amongst the current ecosystem, though the exact impact cannot be measured until more results come in.

For sales & marketing leaders, we’d like to offer this advice. As the enthusiasm regarding the technology ensures that there will be strong interest within the foreseeable future, brute-forcing outreach would not be the ideal approach. Rather, demand generation and sales-qualified pipeline specialists for RPA vendors should focus their efforts on targeted account-based sales and marketing outreach. The goal shouldn’t be applying a one-size-fits-all approach towards RPA implementation but identifying and securing the business of enterprises where your solutions will deliver clear ROI. These ideal buyers are out there but they must be guided through their digital transformation journeys, with a very clear understanding of how the technology can help them achieve their desired goals.

At the initial stage of outreach, your sales & marketing teams must rigorously filter out bad-fit leads during the qualification process. This is not just to ensure that these prospects move smoothly through the buying journey, but to guarantee that a long-term relationship between vendor and client will show a history of success. As the market matures, it’s increasingly become more important for RPA vendors to prove specific value to the customers that they help. At this point the success of the previous transactions auto-generates the next leads. In other words, quality outreach leads to tangible financial returns.

Rigorously qualifying enterprise prospects for success

It is not hard to see that we are headed towards a future where RPA is viewed as a strong platform, where the enterprises can quickly build applications that automate the full scope of business processes, surpassing the earlier RPA’s model that revolved around using bots to automate mere tasks. It’s crucial that RPA vendors have strong customer success stories to base the future growth of their business off of. Furthermore, in the wake of the coronavirus, prospects will be harder to reach directly, digital marketing efforts are not effective alone. Therefore qualifying them will be a slightly new task.

Finding these ideal C-level, decision making candidates, qualifying their needs and filtering out the noise is a labor-intensive process. Enterprise prospects will likely spend more time deliberating on how to implement RPA solutions, which means that salespeople will likely need to spend more time helping them chart out and navigate a path toward successful deployment.

The RPA market is still fragmented and highly competitive. Therefore, the vendor of a high-quality product can avoid bottlenecks by implementing targeted account-based marketing strategies, where outreach specialists focus specifically on helping their enterprise customers understand what they want to achieve and help build a roadmap to this end. The foundation of outreach success comes with a team of sales development representatives (SDRs), knowledgeable about the possibilities within its portfolio, and the scalability of the product line - the necessary elements allow to meet most of the customers’ needs. One cannot overestimate the value of the sales SDRs able to identify the prospects across multiple geographies, initiate the enterprise sales opportunity at large accounts with surgical precision, and generate the sales pipeline with the quality that turns into long-term customer relations.

Consider working with a sales development BPO partner to help with the initial large account outreach stage and generate an enterprise sales pipeline, so that your sales organization can dedicate more of its internal resources to the planning and negotiation stage. To get some help choosing the right vendor, be sure to do your due diligence. If you’d like to collaborate with us, get in touch for a consultation session.

Growth process outsourcing is BPO for complex sales and marketing processes. Business process outsourcing (BPO) is a familiar term for most in the...

What we call agile account-based marketing (AABM), is a newly emerging discipline. As such, the industry of marketing service providers - agencies...

Evolving the SDR Role The business landscape is in constant flux, and with it, the role of the Sales Development Representative (SDR) must evolve. As...

Account-based marketing is going agile Account-based marketing (ABM) has been the go-to approach for enterprise technology in the past decades, even...

What’s the philosophy behind the technology of the most successful ABM programs? Answering this question was not the original intent when we set out...

Marketing goes beyond promotion. Marketing is creativity, profound planning, understanding of your audience, analysing data – especially nowadays,...

The industrial sector seems to experience major lags regarding digitalization and automation – the latest trend that is currently defining the...

A new business model for outsourcing enterprise growth activities: Growth Process Outsourcing! It’s no news that outsourcing is a red-hot trend....

If you’ve clicked on this article, there’s a fair chance you are considering outsourcing your sales, marketing, customer success and overall revenue...

The recent pandemic, economic slowdown, and accompanying uncertainty have resulted in a temporary interruption in how enterprises procure technology...

Account-based marketing has been all the rage in the B2B world with big promises, new lingo, new buzzwords. We’ve been finding that it isn’t always...